Investigating Insurance Services: Their Role in Protecting Your Life and Well-Being

Insurance coverage is vital in ensuring financial safety against unforeseen occurrences. These services include many types, such as health, auto, and homeowners insurance, intended to address unique hazards. Grasping the operation of these services is crucial for anyone seeking to protect their assets and well-being. When people deal with the complexities of insurance, they may often ask what coverage best suits their unique circumstances. The answers could heavily influence their future security and stability.

Grasping the Various Types of Insurance

While most people understand insurance is important, knowing the various types can be a challenge. Insurance encompasses a broad area encompassing multiple categories, each created to meet specific needs. Health insurance, as an example, covers medical expenses, offering people access to healthcare services. Auto insurance protects against financial loss in the event of car accidents or theft. Homeowners coverage safeguards property against damage or loss due to events like fire, theft, or natural disasters. Life coverage provides monetary support to beneficiaries upon the policyholder's death, ensuring their loved ones are cared for. Furthermore, specialized types exist such as disability insurance, which offers replacement income if an individual is unable to work because of illness or injury. Each category has a distinct function, highlighting the importance of evaluating personal needs to pick the best coverage. Understanding these differences is essential for making smart decisions about coverage options.

How Insurance Works: The Basics

To understand how insurance works, one must understand the core principle of risk mitigation. Insurance functions based on the idea of pooling risk among many individuals. When a person purchases an insurance policy, they commit to paying a premium in exchange for coverage against potential financial losses. This system permits carriers to collect funds from many clients, building up capital to cover claims from resource policyholders incurring damages.

The process begins when individuals assess their personal risks and choose suitable protection plans. Carriers subsequently analyze these risks, setting rates using criteria like lifestyle, health, and age. By distributing the cost among many participants, coverage reduces the effect of unexpected events like accidents, illnesses, or natural disasters. Ultimately, this system provides policyholders with peace of mind, knowing they have a safety net ready for when unpredictable situations happen.

The Value of Being Insured

Possessing insurance provides a multitude of upsides which significantly boost financial security and peace of mind. A key advantage is the security it delivers against unexpected financial burdens, for instance, damage to property or healthcare costs. This secure framework permits clients to manage risks more effectively, knowing they have support in times of need. Furthermore, insurance protection helps grant entry to necessary resources, like health services, that would otherwise be too costly.

In addition, being insured promotes greater life consistency, allowing people to concentrate on objectives without continually stressing regarding future monetary losses. It can also enhance creditworthiness, as lenders often view clients with coverage in a better light. Taken together, insurance is a vital mechanism in mitigating exposure, fostering assurance and strength in facing life's uncertainties and protecting general welfare.

Finding the Appropriate Insurance Policy

How can individuals navigate the complex landscape of coverage choices to locate the protection that fits their individual needs? Initially, clients must evaluate their particular requirements, considering factors such as financial duties, health status, and family size. This assessment assists in refining the necessary forms of coverage, such as life, health, homeowners, or vehicle insurance.

Subsequently, people should investigate multiple insurers and contrast their policies, paying attention to deductibles, limits, premiums, and policy specifics. Reading customer reviews and requesting referrals may also offer useful information.

Budget considerations are essential; individuals should choose a policy that maintains sufficient protection while remaining inexpensive. Moreover, reviewing the stipulations of each policy guarantees that there are no surprises during the claims process. By taking these steps, individuals can decide wisely, finding the ideal insurance protection that fits their specific needs and financial goals.

The Future of Insurance: Trends and Innovations

The future of insurance is poised for significant transformation, fueled by emerging technologies and evolving customer requirements. Insurers are increasingly adopting artificial intelligence and machine learning to improve risk evaluation and accelerate the claims procedure. These innovations make tailored policies possible designed for individual needs, building client dedication and satisfaction.

Moreover, the rise of insurtech startups is redefining standard insurance approaches, promoting agility and competitive pricing. Blockchain technology is seeing increased adoption, providing better visibility and security in transactions.

Furthermore, as consumers become more environmentally conscious, demand for sustainable insurance products is rising. Insurers are innovating to offer coverage that is consistent with eco-friendly practices.

Telematics and wearables are continuing to transform health and auto insurance, offering instant information that can lead to more accurate premium calculations. In conclusion, the insurance landscape is evolving rapidly, prioritizing convenience, personalization, and sustainability for a new generation of policyholders.

Common Queries

What Steps Should I Take After Experiencing a Loss Covered by Insurance?

After experiencing a loss covered by insurance, an individual should quickly contact their insurance provider, take notes on the destruction, obtain supporting documentation, and file a claim, making sure to maintain logs of all communications throughout the process.

On What Basis Are Premiums Set for Different Individuals?

Insurance premiums are calculated based on factors such as age, health, location, coverage amount, and evaluation of risk. Insurers review these elements to gauge the chance of a loss, consequently establishing suitable premiums for individuals.

Am I Able to Alter My Insurance Coverage Before Renewal?

Certainly, individuals can typically change their insurance policy mid-term. Yet, this procedure might differ based on the insurer's terms and conditions, possibly influencing the coverage, the costs, or necessitating fees for revisions performed.

What are the Typical Limitations in Policy Contracts?

Common exclusions in insurer contracts include prior medical issues, willful destruction, acts of war, catastrophic events, and some hazardous behaviors. Policyholders should carefully review their policies to understand these limitations and avoid unexpected denials.

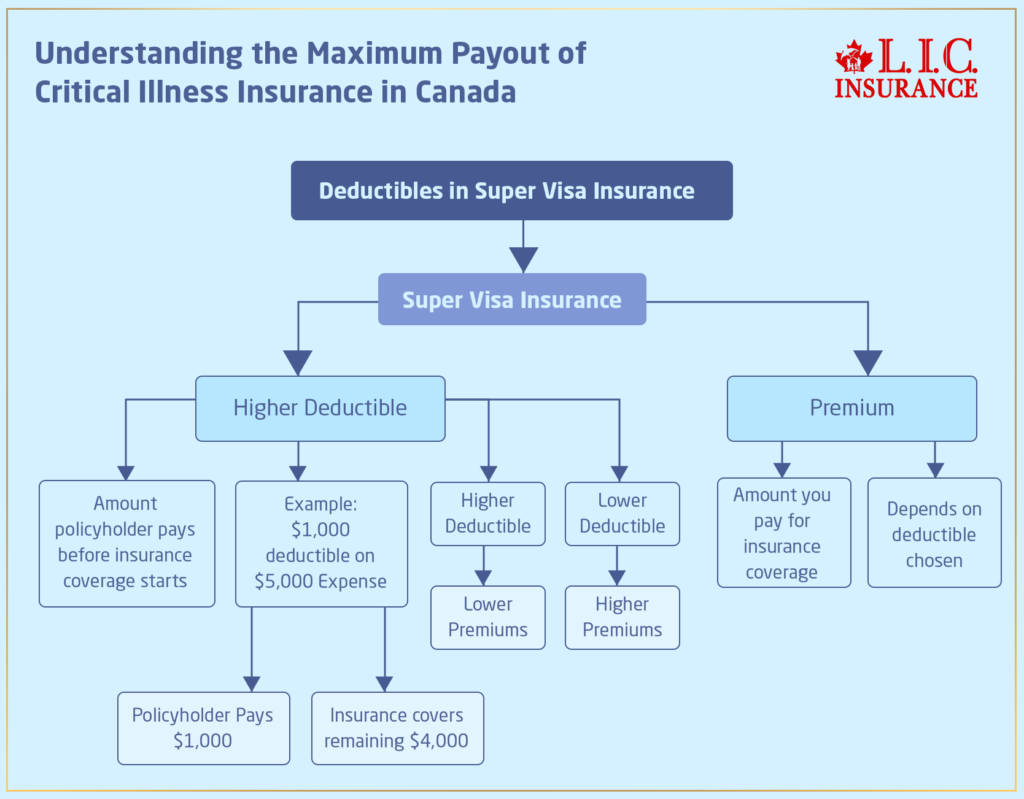

How Do Deductibles Affect My Coverage Payouts?

Deductibles reduce the provider's reimbursement level by requiring policyholders to cover a set upfront amount before payouts are handled. This significantly affects the final payout amount, affecting the complete monetary obligation in times of loss.